“Are you looking for grand business in forex. Be punctual and activate your account. Go for global development and incline yourself to specific gateway with the aid of a reliable payment processor.”

Have a secure business through ePay forever. If you are leading a forex deal relating to secure payouts, go for instant payments. If you are leading a grand business, several people may create major breakthrough in competing in the world market. It is better to take the help of payment processor making you inclined to deals. Have secure funds with outstanding broker account at domestic and international level. Thus compete thoroughly with safe and secure payment gateway offering Forex Merchant Account, United Kingdom making you boom absolutely without any hindrances.

Forex Trading Website

Many merchants are inclined to forex trading and make a website, get to know about a broker market from their end. Currencies play a major role in making your fund safer into your account. This is how you can touch the business height by selling your shares on national level and also about seeking awareness of gold, silver and other metallic product. There might be inflation and deflation related to metals. Besides, diverse currencies play a major role in making you know about overseas market. International payments become easy as many merchants look for outstanding business. Merchants from different nations can collect funds easily and know about ins and outs of current global economic development. This is how you can count upon for industrial transaction with speedy progress on market front. This can lead you one step forward in local market aware of all the economic development taking place securely. Making you intend to go through all the current development internationally related to forex.

Leading experts for Forex (Trading) business

If you are thinking to move your business related to forex and wants to go higher-up in deal then look for expert team. Just considerably get awesome payment. This is how you have to attempt for industrial transactions related to forex. Generate your payouts high while you run your transaction from one end to another. Think more on payment gateway while you select appropriate payment processor. The team of specialists will offer you grand wayout to make you count upon the gateway holding your volume of deals.Just call the team or apply online and tell about the details of your business. This is the way to connect to the experts and make your trade boom on market front. Are you so much definite in your choice then think more on perfect trends. The experts will offer you accurate gateway making you develop your transactions.

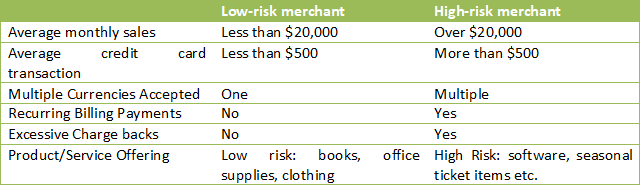

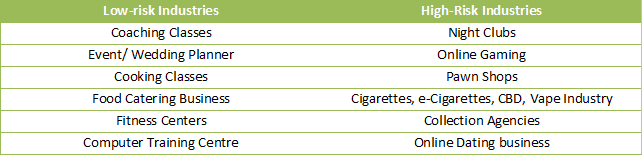

High-Risk Payment Gateway Solution

Thinking more on forex inclines you so much that you can make a major deal. “Do you have hard and fast rule?” Then think twice on all levels seeking high-risk payment gateway with a complete solution in mind. Are you accurate in getting the right amount while you sell the diverse currencies? This is how you can buy and sell the currencies according to market trends. The increase and decrease in forex may make you aware of high-risk gateway transaction procedures. Thus high-risk payment gateway works wonder for merchants seeking effective forex broker’s business. Need for Merchant Account, United Kingdom increases considerably making you standout from other competitors on national and global level.

Services you receive

As you go through your business deal, you can be inclined to particular payment gateway. This is how the whole procedure you go through while you are getting inclined to forex trade. Are you still secure, do not be in doubt as you advance through grand set up including several services. Various amenities include Credit Card or Debit Card Processing, High-Risk Gateway, Domestic and International Account, Fraud Tools and several more makes you go for payment gateway wayout. Thus our amenities offer you terrific deal in few days time.

Many merchants find easy to deal through credit card and debit card processing. This offers you grand deal in few minutes.” Are you connected well online if you are a forex merchant; consider the best gateway without doubt.” The cards like Visa, MasterCard and many more provide preference to forex traders and so take it as acceptance.

Trust Our Services

As a forex merchant, trust our services and get in touch with our experts. This is how ePay believes in setting up the best deal by connecting online. You can get all the current development in tools while maintaining your website. Day to day businesses make you know further about the latest development in forex. As a dealer in business, you can connect to several clients who are interested in buying and selling of shares or dividends. This entails you to progress forward with diverse info related to transactions.

Overcome the faults

Many merchants derive the superb payment driving lots of people to forex website. You can overcome all the mistakes in payment processing. Thus aid in developing swift transaction in short time. Therefore look for Forex Merchant Account Solutions, United Kingdom in few days time with ePay solutions in mind.