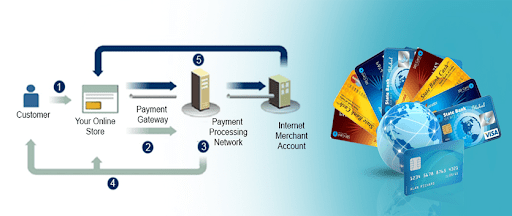

The chargeback is the most negative thought when it comes to business payments. A chargeback is a return of money with the payer of some transaction esp. the credit card transactions. The chargeback reverses a money transfer through the customer’s bank account or the line of credit along with a credit card. The secure online payments with the bank transfer are like cash transactions. The customer authorizes the purchase along with the funds found as a guarantee. The bank amount transfers are the safest way to choose the amount. The chargeback is raised by a credit card that also provides issuing company with the bank from a retailer along with fulfilling the loss of fraudulent activity or through malicious transactions.

The no chargeback the gateway leads to working with chargebacks in the form of eCommerce with these many effective methods by Eskaypays:

- Enabling 3d secure payment gateway: The 3d secure leads to adding an extra layer of security with checkout and reducing overall chargebacks gives protection in business against all kinds of frauds.

- Early warning chargeback prevention: The early warning chargeback prevention leads to working with consumers through card issuing bank and at the same time disputing chargebacks. It also leads to eCommerce merchants that issue a refund to consumer and avoiding any dispute leading to chargebacks.

- Chargeback fighting service: The chargeback fighting is done with the help of no chargeback gateway by Eskaypay and gives the best chance of winning momentum in the business.

- Liability shift: The liability shift leads to securing with the risk of liability which gets associated with some transactions and shifts from merchants to the cardholders issuing banks by Eskaypay.

- Customer trust: Customer trust leads to feeling more confident both for the business as well as the consumer and gives an extra level of security while protecting the transactions by Eskaypay.

Fraud is the biggest occurrence on the internet and internet penetration has almost become rampant these days. The securing of online payments with bank transfers lead to work with no chargeback gateway by providing a safe way for e-commerce business gets successful. More than 50% of e-commerce shoppers get worried about deteriorating privacy matters and identity theft is also a major concern. The experiencing of loss of money with the sale of the product along with the cost of chargeback leads to an increased chargeback ratio with negative impact through high-risk credit card processing accounts.

The no chargeback payment gateway leads to securing of business that works through a high-risk merchant account. The method works through the complete elimination of chargebacks along with efficient methods of payments through business operations. The chargeback leads to multiple working reasons with the customers getting unsatisfied which get diverted on time, material, and other such reasons. The most common reason leading to the chargebacks are found is certainly fraud which happens most of the time through cybercrime. The bigger concern found is of friendly fraud and it may happen with loopholes in the business with no chargeback payment gateway.

The no chargeback gateway by Eskaypay has certain distinctive features found here:

- PCI Compliance

- 3D secure authentication

- Analytical gear with billing subscription

- No charge found on excessive declines

The superior Eskaypay service with PCI-compliance payment gateway is designed for the high-risk merchants. It also reduces gateway costs and provides merchants with the highest standard in terms of fraud protection. Eskaypay reduces chargebacks and also recovers merchants with revenue lost to any instance of fraud by dispute management services. It reduces chargeback and also wins disputes through various necessary representation. The credit card processing with merchant servers also leads to work with eCommerce, card presentation, recurring billing, and subscription working with authorized sellers.

The few other necessary an aspect which is required with taking the help of no chargeback gateway by Eskaypay are as follows:

High-volume processing: The high-volume merchant accounts work with establishing single high-volume fraud protection and gives business better responsive services.

Multiple payment options: The multiple payments options through credit and debit cards with no chargeback transfers with more protection on sales from international buyers by Eskaypay.

PCI-DSS Level one security: The PCI-DSS level one security enabled features protects sensitive consumer data.

Superior customer service: The highly trained executives lead to work with the help of business and work with dedicated service that gives better solutions.

Now, after knowing all aspects of the business with no chargeback gateway by Eskaypay it is necessary to know how the chargeback affects various industries. Many of the industries accept payments through credit cards and with the various credit cards that lead to fulfilling the loss of fraudulent activity. The better payment solution through various banks increasing business revenue along with a rapid increase in profits. The better payment solution leads to cost-effective transactions along with better credit ratings and work well for high-risk as well as low-risk business increasing goodwill for the business.

Tags: 2d Payment Gateway, Best High Risk Payment Gateway, online Credit Card Processing, Offshore Payment Gateway