The Internet has opened a new bar to explore for global business. The continuous evolution of technology and the Internet has made international companies more approachable.

As per a recent report, The Global e-commerce sales amounted to more than $ 3.5 trillion worldwide in 2019, and this number is expected to hit $ 6.5 trillion in 2023. This record shows the opportunities available in the market for merchants.

Before opting for payment gateway service, you should question your business what it requires? And is the service provider compatible for your business?

Few points to consider –

- High volume processing

- Minimal transaction fee

- No hidden cost

- Multiple payment gateways

- Diverse currency processing

Does my business need a payment gateway?

Yes, every business needs a payment gateway. Companies need to embed payment gateway with their website to grow their business in a fastening-way.

But first, we need to know, what is the payment gateway?

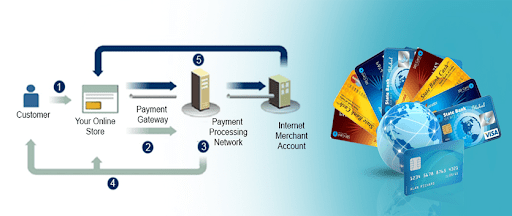

A payment gateway is software that verifies the client’s card details and sends details to the payment processor. It provides credit card and direct payment processing for the businesses, online retailer, and others.

Many businesses have many clients worldwide. Many applications and social media are helping businesses in advertising, marketing, and sales.

But, online payment methods must be the only option when we talk about selling any product or services online. And to accept international payment, you need an International Payment Gateway.

ePay Global gives you the plot to manage your payouts

As we know, all international payments are considered high-risk, and businesses involved in it are considered high-risk businesses. And getting payment gateway service for such industries is quite challenging. Financial institutes and banks do not prefer to provide service to high-risk industries. At this point, ePay Global comes as a solution for merchants.

ePay Global is a well-established payment gateway service provider in the market. We have a speciality in dealing with high-risk merchants.

We offer an International Payment Gateway along with International Merchant Account to the merchants. Merchants get the ability to accept card payment with merchant account service.

Why do I need ePay Global International payment gateway?

- Secure and reliable – ePay offers you a fast payment gateway integration to process your transactions. Our International Payment Gateway complies PCI-DSS Level 1 compliance, along with SSL encryption and API integration. We help the merchant in providing a safe and straightforward payment experience to their customers. Our security tools protect you from data theft and attackers.

- Convenient for your customers located abroad – Merchants get the option to offer a convenient payment mode to their international customers without any hassle. An International Payment Gateway works as a bridge between merchant and customer. It helps merchant to collect their payouts from their global customers.

- Multiple payment methods and Diverse currency processing – ePay facilitates merchants in processing numerous currencies on real-time. Merchants can receive their payouts in various currencies from their customers. They get eligible to show local currency payment option at their portal. Besides, we also provide different payment methods to collect their payout. They can accept payment via Cards, ACH, eCheck, mobile payment, and more.

- Protects merchants from chargeback and frauds – Friendly frauds and chargebacks are widespread in the global market. Every merchant should consider it while opting for payment gateway. ePay Global helps merchant with its anti-fraud tools and chargeback management to tackle with these. It verifies all transactions in real-time and secures your business from fraudulent transactions. Our chargeback management helps you in tackling with a chargeback in every possible way.

- Easy report generation and account reconciliation process – Merchants get the ability to check all kinds of report. All reports easily get generated automatically in the dashboard and help with monitoring the growth of your business. Your account gets reviewed in every 90 days.

- How volume processing – ePay Global offers you to process as much transaction you want with its International Payment Gateway. Acquirer banks connected with us do not put the cap on transaction volume and entitles you to process maximum transactions against your sales.

- Reliable customer support – Having a dedicated customer support is a crucial need for any business. ePay Global offers you reliable customer support 24*7.

International Credit card processing

Credit card payments are genuinely international. All the credit card associations, banks, financial institutes, and government oversight agencies collaborate to bridge global payment gaps.

ePay Global offers international credit card processing with its International Payment Gateway. Credit card processor gives the ability to tackle offshore processing in real-time. Your customer can pay in their desired currency with the help of credit card. ePay Global supports all major currencies around the world.

Credit card payments help merchants in improving their customer relationship with their client. Finding card payment available at your payment page makes your business more legitimate for your customers.

Tags: Online Credit Card Processing, ACH Payment Processing, payment gateway, High risk merchant account